Insights from the events Tech Japan Advocates has hosted for investors to discuss increased collaboration between the UK and Japan, and outlining best practice for UK entrepreneurs to engage with Japanese investors.

Tech Japan Advocates share insights on collaboration between the UK and Japan

Co-authored by Tadashi Tamura

Introduction – Tech Japan Advocates (TJA)

It is said that developing a business relationship in Japan is among the most challenging, but that those relationships will last forever.

Tech Japan Advocates (www.techjapan-advocates.org) was founded in 2019 to connect technology startups and investors with innovation communities around the world. We do this in collaboration with the 18,000 members of Global Tech Advocates (www.globaltechadvocates.org) and other global innovation networks. TJA was launched by Tadashi Tamura and Nelson Skip Riddle who have worked together since the 1980s. Over 100 TJA members and advisors are supporting Japan’s innovators with mentoring and making connections to help them to grow, both domestically and internationally. Most recently, TJA helped to organise two Japan/UK investor video conferences that produced useful knowledge exchange and connections, already leading to collaborations in fintech and other sectors.

Japan – An Economic Powerhouse

Japan is the world’s third largest market, representing about 10% of the world’s economy with 126 million people.

During the past 70 years, government-funded capitalism created a sustainable environment for Japanese industries to flourish. Japan also benefited from family-owned business conglomerates – bank-sponsored zaibatsus and industry-sponsored keiretsus. The focus evolved from machinery, including steel, shipbuilding and automotive, then leadership in electronics products – and the engineering and technology behind them. Computers and semi-conductors soon logically followed. Japanese companies could borrow money at very-low interest rates sponsored by the Government’s low-interest monetary policy, and this helped emerging companies to focus on business growth rather than profitability.

Toyota, Panasonic, Sharp, Nintendo and Toshiba among others benefited from these well-organized cliques. STEM-based university education and scientific research funding have also produced a steady stream of innovations during the past 70 years.

The Market for Technology Innovation in Japan

Japan has become an innovation powerhouse. Today, 25% of the world’s high-tech products are made in Japan, while many of the recent global technology revolutions started in Japan.

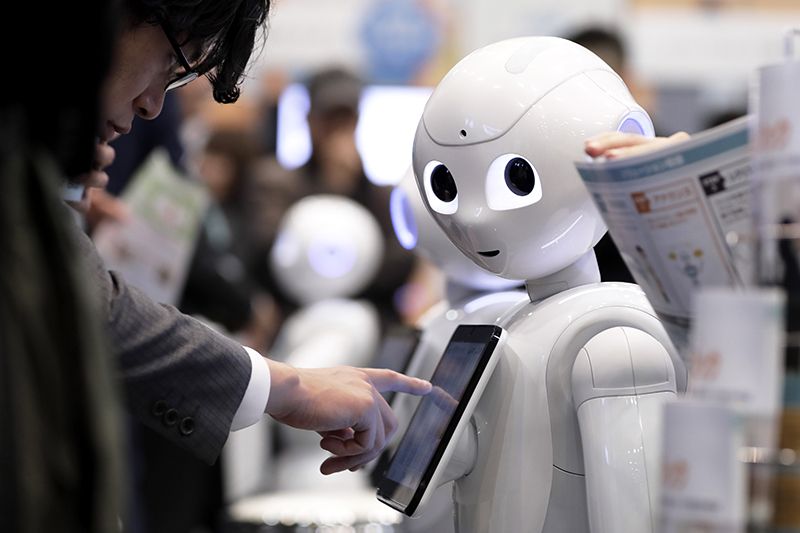

Today, Japan is producing cutting edge technology and solutions in several areas: Nuclear energy, aviation and space exploration, robotics and AI, high-speed trains, batteries, microscopic circuits, and food/organ preservation. Japan’s share of the ICT-related patents in relatively high and internet usage is also high.

Japan is also adopting advanced technologies from other countries to transform its industries and social mobility, as it endeavors to reduce trade barriers and red tape. For example, Revolut, a UK company, considers Japan one of its most important markets. Its economic power is producing substantial investment vehicles such as Softbank and several corporate venture capital funds (CVCs) to underwrite innovations and international expansion.

Japan’s startup ecosystem is still nascent. While venture capital investment in the U.S. exceeded 100 billion U.S. dollars in 2019, domestic startups in Japan received only about 2 billion US dollars in venture capital. Traditionally, CVCs have been the main seed-funding source for start-ups, while big corporations relied primarily on in-house R&D and a focus on the “keiretsu” structures around them. Japan’s R&D spending is high, and its research population is extensive. But international liquidity is low.

In the past, Japan’s peculiar regulatory systems and lack of government financial support for independent innovation outside the industrial consortia undermined entrepreneurial enterprises. So, too, social norms mitigated against new, risky ventures. Traditionally, once you fail in Japan it is difficult to recover socially and in the business world.

More recently, regional government funding and corporate “open innovation” initiatives are increasing support for startups, especially domestically but also overseas innovators in fintech, AI, HealthTech, mobility technologies and SaaS technologies. Tokyo is the geographical center for startups, with Osaka, Kyoto and Fukuoka also producing active startup communities. Accelerators such as Finolab, Cambridge Innovation Labs, Plug & Play, and Startup Boot Camp Osaka are among those that are helping overseas and domestic startups to launch and scale in Japan.

Guidance for UK companies entering Japan

Companies entering Japan face several challenges:

- Japanese customers can be very demanding, and often have quite different tastes and needs than western customers. Therefore, in many cases western companies must redesign or redevelop products in order to succeed with Japanese customers.

- In many cases, western managers and Western management teams are ill-prepared to succeed in Japan. Changes in such thinking and management methods would be necessary to succeed in Japan.

- Because of Japan’s size, substantial investments are necessary, and therefore the inherent risks are also large.

- Japan has many extraordinarily strong local companies. One must be prepared for such competition with thorough market research and strategy development.

- Relationships are critically important in Japan, a “high-context” culture where relationships and trust are paramount. One can build that trust by showing commitment to Japanese business partners and customers, consistently.

So, if you still have an appetite for Japan, a few well-accepted guidelines:

- As you build relationships, take care of your relationships, understand why and with whom you build relationships, and avoid certain kind of relationships.

- Do your homework: In your own country it will be easier for you to make guesses about what your partner could think and feel, while in Japan this will be more difficult. Too often westerners misinterpret commercial relationships, producing significant losses of time, money, and reputation.

- Demonstrate your commitment to the market by organizing local, Japanese representation once you have decided to enter Japan. Initially that can take the form of a well-respected Japanese advisor. However, soon it will require investing in local business development and technical support capabilities, preferably augmented via a partnership with a local, well-connected, and trustworthy operator.

- The “keiretsu” (industrial groups) hold substantial sway over commercial decisions made in Japan and, in some instances, it will be necessary to partner with one of them.

- Given the high-context, hierarchical nature of Japanese culture, “etiquette” plays a large role in conducting business with them. If you want the Japanese to trust you, then following these protocols is key. From the proper exchange of business cards to extensive documentation, to preparing for meetings, being on time and appropriate seating in meetings… these signal respect for Japanese values and are essential to produce trust.

- Guidance and support are also available from several government-funded agencies in the UK and in Japan

Working closely with Global Tech Advocates, we intend to help others to learn more about this most interesting country and culture, and benefit from a lucrative, growing innovation community.

Tadashi Tamura, TJA Tokyo

Nelson Skip Riddle, TJA London